The shifting global dynamics and a cautious consumer sentiment have created a new, surprising epicenter of growth for the premium lifestyle and personal goods arena, not in traditional Western capitals, but across the Gulf Cooperation Council (GCC). The GCC Personal Luxury 2024: Unstoppable report, released by the Chalhoub Group in May 2025, presents a compelling, data-driven portrait of this six-nation bloc, comprising the UAE, Saudi Arabia, Qatar, Kuwait, Bahrain, and Oman. It is not merely weathering international uncertainty, but spearheading a new model for luxury resilience and reinvention.

Amid geopolitical tension and a modest contraction in personal luxury globally, the GCC recorded USD 12.8 billion in personal luxury spend, up +6% year-over-year in 2024. The report blends macroeconomic analysis, consumer sentiment, and category-specific insights, drawing a rich, interconnected narrative of ambition, diversification, and cultural transformation.

A Region Rising Against the Current

While the global personal luxury space declined by 2%, the GCC expanded by 6%, reflecting strong domestic demand, tourism, and high consumer confidence (2024). Leading this surge are the UAE and Saudi Arabia, which together represent nearly three-quarters of regional spend.

- UAE: Maintains dominance as the luxury capital of the region (56% market share), driven by record tourism and retail innovation.

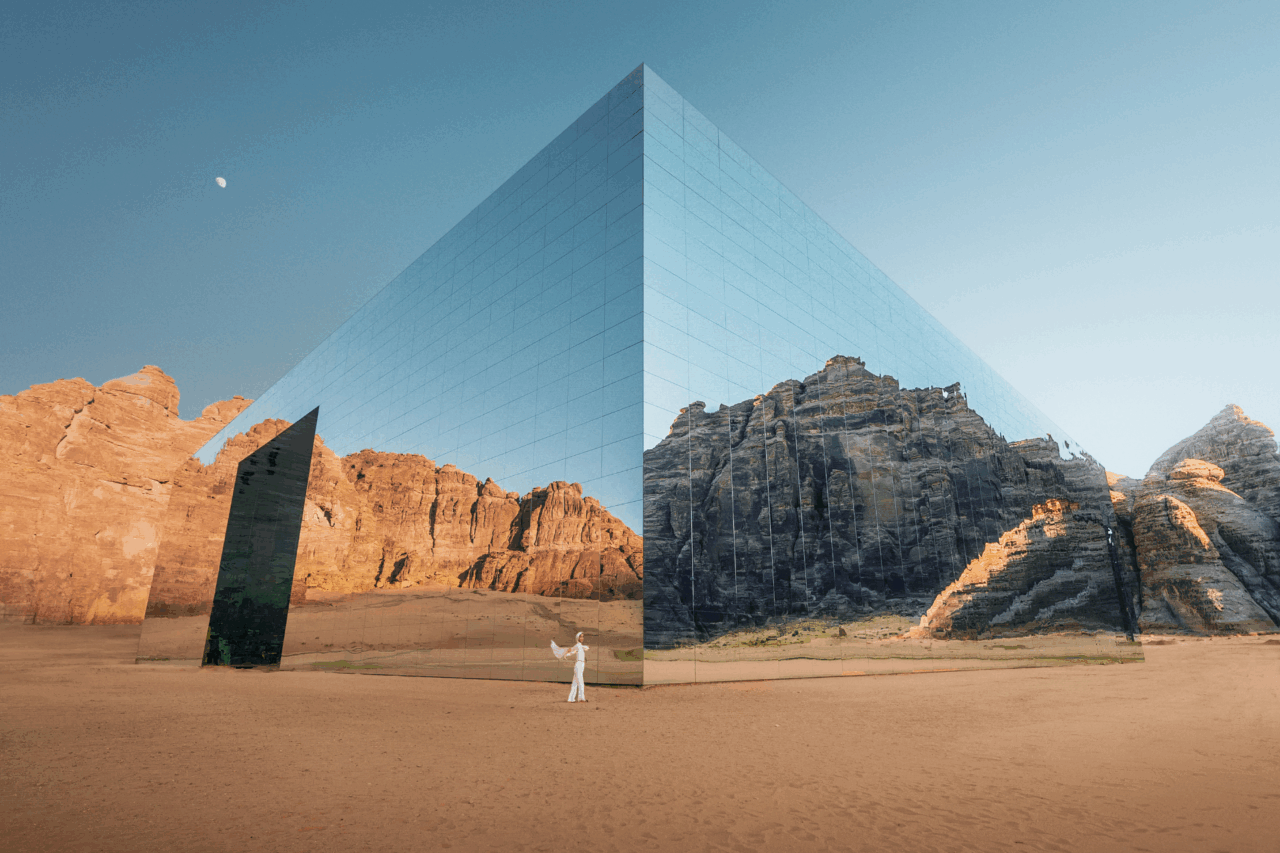

- Saudi Arabia: Fast-growing player with a dynamic retail landscape and large-scale infrastructure projects supporting luxury expansion.

What’s Powering GCC Growth?

The Chalhoub report identifies five foundational drivers behind this region’s exceptional performance:

- Government-Led Economic Vision: Initiatives like Saudi Arabia’s Vision 2030 and Dubai’s D33 plan are transforming oil-based economies into diversified ones, focusing on financial services, AI, and renewable energies in order to reduce their dependence on oil.

- Affluent and Optimistic Consumers: 97% of surveyed residents plan to keep spending on luxury, focusing on quality, exclusivity, and brand integrity.

- Tourism as a Luxury Channel: With international arrivals up by 8% and VAT refund claims rising, tourism is directly driving luxury sales, especially in the UAE.

- Retail Renaissance: Over 90 new luxury fashion and beauty stores opened in 2024 across malls in Riyadh, Dubai, Doha, and Manama, with brands like Hermès, Dior, and Zimmermann entering or expanding. Luxury Fashion represents 43% of expenditure in the GCC personal market.

- Digitally Native Behavior: E-commerce is growing, led by players like Sephora, Ounas, and FarFetch

Where Luxury Lands: Key Sector Insights

Fashion remains the region’s cornerstone, contributing 43% of the luxury market and growing +6% YoY. The report distinguishes four tiers:

- Ultra High-End Fashion (e.g., Loro Piana, Louis Vuitton): 57% market share

- High-End (e.g., Gucci, Tom Ford): +8% growth

- Aspirational (e.g., Ferragamo, CH): supported by new entrants like Jacquemus

- Accessible Luxury (e.g., BOSS, POLO): +7% growth aligned with global trends

Watches & Jewellery (W&J) account for 38% of total luxury spend.

- Jewellery saw +7% growth, driven by consumer emphasis on craftsmanship and heritage.

- Watch sales remained flat following global patterns of maturity in the segment.

Prestige Beauty is the fastest-growing category

- Skincare leading the way (+17%), driven by The Ordinary, Drunk Elephant, and Charlotte Tilbury.

- Fragrance capturing 49% of beauty spend, dominated by niche and private-label collections.

- Makeup is seeing double-digit growth, with strong traction from Fenty, Glossier, and Urban Decay.

Insights on the Intentional GCC Consumer

Today’s GCC luxury consumer is not only affluent but deeply informed and highly discerning. Over 87% actively follow fashion and beauty trends on social media, while more than half consider themselves well-versed in brand identities, seasonal collections, and product innovations. A striking 79% of consumers have traveled in the past three months, with the majority of them shopping abroad, often spending up to 2.5 times more than they do locally. When it comes to purchasing decisions, quality remains the top driver, followed closely by alignment with personal style and a brand’s authenticity. This is not a market driven by impulse or novelty; it is one defined by intentionality, taste, and a desire for meaningful, informed indulgence.

Final Reflections from the Gulf

Looking ahead, the Gulf region is determined to participate in the global luxury narrative and actively shape it. With continued investment in urban development, the debut of new luxury malls, and the entrance of next-generation brands across categories such as wellness, skincare, and athleisure, the GCC is steadily evolving into a hub of innovation and cultural influence. The Chalhoub Group forecasts that the personal luxury market in the region will reach USD 15 billion by 2027, supported by rising local affluence, a vibrant tourism sector, and increasingly sophisticated consumers. E-commerce is expected to deepen its role, particularly through pure-play digital platforms, while experiential retail continues to reimagine the luxury shopping experience.

However, this growth story is not without its challenges. Macroeconomic risks, shifting global trade dynamics, and ongoing geopolitical tensions present uncertainties that may impact future performance. Yet despite these external pressures, the prevailing outlook is one of quiet confidence. The GCC has not only demonstrated resilience, but it is also redefining what modern luxury means, blending heritage with innovation, exclusivity with accessibility, and global aspiration with regional authenticity. For brands seeking long-term relevance, the Gulf is a strategic imperative.

To read the full report by the Chalhoub Group, visit: https://www.chalhoubgroup.com/fr/media/324/gcc-personal-luxury-market-defies-global-trends-with-6-growth-reaching-usd-128-billion-in-2024

Stay up to date on the latest luxury industry news: https://worldluxurychamber.com/insights-news/