Despite global macroeconomic headwinds—like inflation, geopolitical tensions, and market volatility—the Hard Luxury sector (watches & jewelry) remained resilient in 2024. However, demand polarized, with high-end and ultra-luxury products outperforming mid-tier offerings.

Below, read our summary of Trinity Asia‘s Watches & Jewelry 2025 Report. See the full report here: Trinity Asia Report

Key trends included:

- A digital commerce surge led by platforms like WeChat, Instagram, and Douyin.

- Growing pressure to prioritize sustainability and ethical sourcing.

- A shifting consumer dynamic, especially between strong performance in the U.S. and challenges in China.

Looking ahead to 2025, growth is expected to return, driven by premiumization, digital transformation, and emerging markets like India and Southeast Asia.

2024 Market Highlights

Jewelry Market

- Valued at $53B, with 1–3% YoY growth.

- Ultra-luxury pieces (>$10K) outperformed; Cartier, Van Cleef & Arpels, and Tiffany led thanks to strong brand equity and digital presence.

- The U.S. led demand, while China’s jewelry consumption fell 17–18%, though Tier 1 cities remained stable.

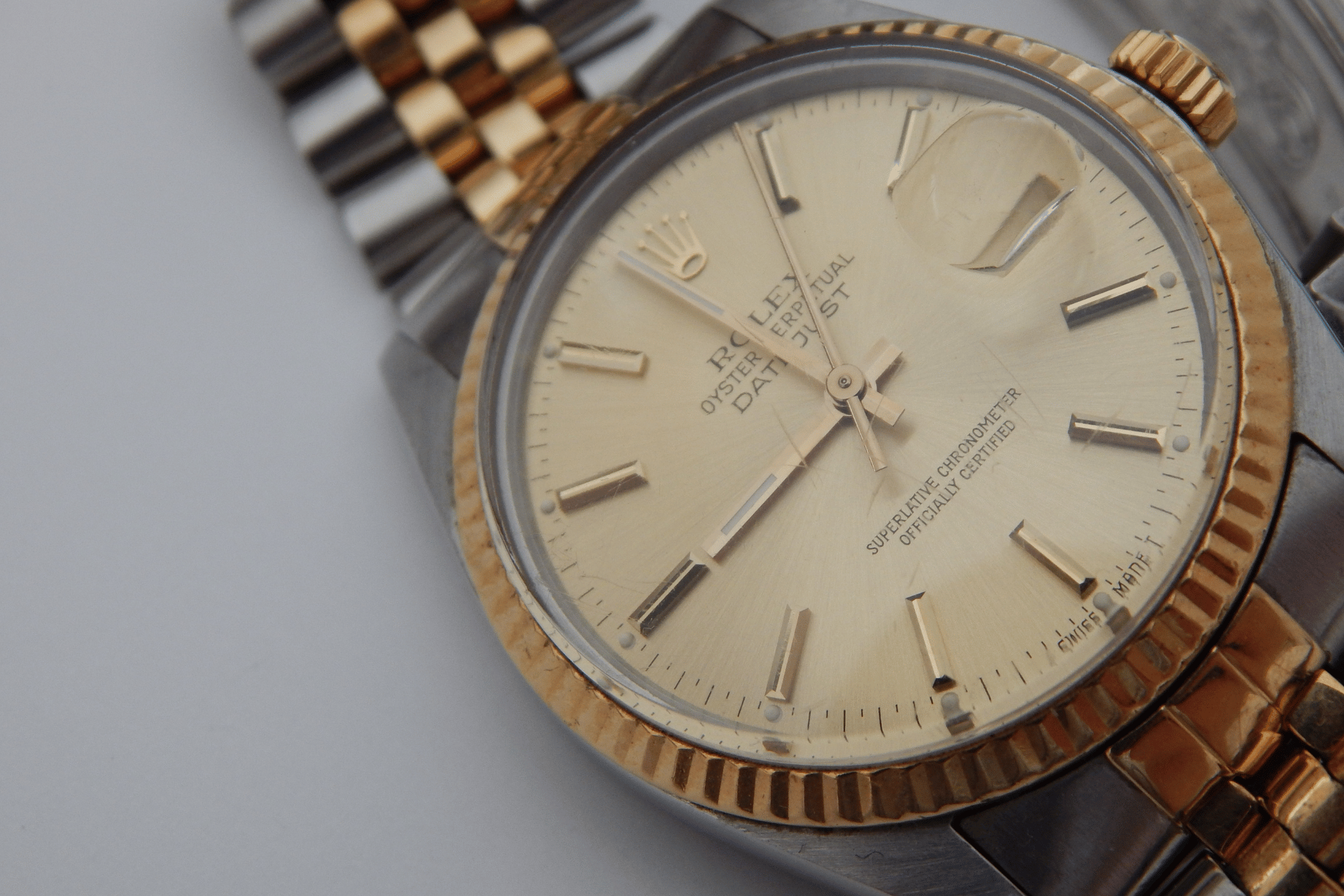

Swiss Watch Market

- Valued at $57B, but experienced a 2.8% YoY export decline.

- Volumes dropped 14.5%, while unit prices rose, reflecting continued demand for high-end models.

- Notable growth by region:

- U.S.: +5%

- Japan: +7.8%

- India: +25.2%

- Europe -0.1%

- China: -25.8%, Hong Kong: -18.7%

Rolex remained a dominant force, especially in the secondary market, although waiting lists began to decline due to price corrections and shifting demand dynamics.

Tariffs & Geopolitical Impact

- U.S. tariffs of up to 24% on Swiss-made watches and French jewelry particularly impacted Richemont and Swatch, who have limited pricing flexibility and high U.S. exposure (e.g., Richemont generates 19% of its revenue from the U.S.).

- Tiffany & Co., with U.S.-based manufacturing, proved more resilient.

- “The real risk lies less in tariffs than in macro fragility,” says Trinity Asia, with wealth erosion and consumer caution more pressing.

Outlook for 2025

Market Forecasts

- Modest global growth expected: Jewelry: 3–5%, Swiss watches: modest recovery, especially in the $10K+ segment.

- U.S. to remain strong.

- India: expected 10–12% annual luxury growth.

- Southeast Asia: projected 5–6% CAGR over 10 years.

Key Trends

- Premiumization: continued focus on iconic, high-ticket items (e.g., Cartier’s Love Bracelet, Van Cleef’s Alhambra).

- Personalization: increased consumer desire for unique, bespoke designs.

- Sustainability: growing pressure for transparency and eco-conscious sourcing.

- Digital-first engagement: essential for capturing Gen Z and millennial luxury buyers.

Strategic Recommendations

Brands should:

- Double down on premiumization with limited editions and signature collections.

- Accelerate digital transformation, especially in e-commerce and social commerce.

- Embed sustainability across sourcing, production, and storytelling.

- Focus on emerging markets (India, SE Asia) with localized, culturally relevant strategies.

As the Hard Luxury landscape continues to evolve, 2025 presents both challenges and exciting opportunities for brands willing to adapt. With shifting consumer expectations, digital acceleration, and a growing emphasis on sustainability and personalization, success will hinge on how effectively brands can balance heritage with innovation. By leaning into premium experiences, embracing emerging markets, and staying culturally and digitally relevant, luxury watch and jewelry houses can not only weather global uncertainties—but redefine what luxury means for a new generation.

Stay up to date on the latest luxury industry news: https://worldluxurychamber.com/insights-news/