The private aviation arena continues to evolve, and the latest edition of Ever Forward: The Pre-Owned Business Aviation Report 2025 by Jetcraft offers an in-depth, data-driven view of where the market is heading. Now in its 11th year, the report examines the intersection of economic, political, and demographic factors shaping the sector, with forecasts extending to 2029. Leveraging over six decades of expertise and a robust global network, Jetcraft’s analysis combines comprehensive transaction data with on-the-ground intelligence to present a clear perspective for industry leaders, investors, and high-net-worth buyers.

The pre-owned business jet market, a significant pillar of luxury mobility, is poised for steady and sustainable growth over the next five years.

Market Size and Projections

- Forecast of 11,202 transactions between 2025 and 2029, representing $73.9 billion in value.

- 2024 saw $13.4 billion in pre-owned transactions, with 64% occurring in the U.S.

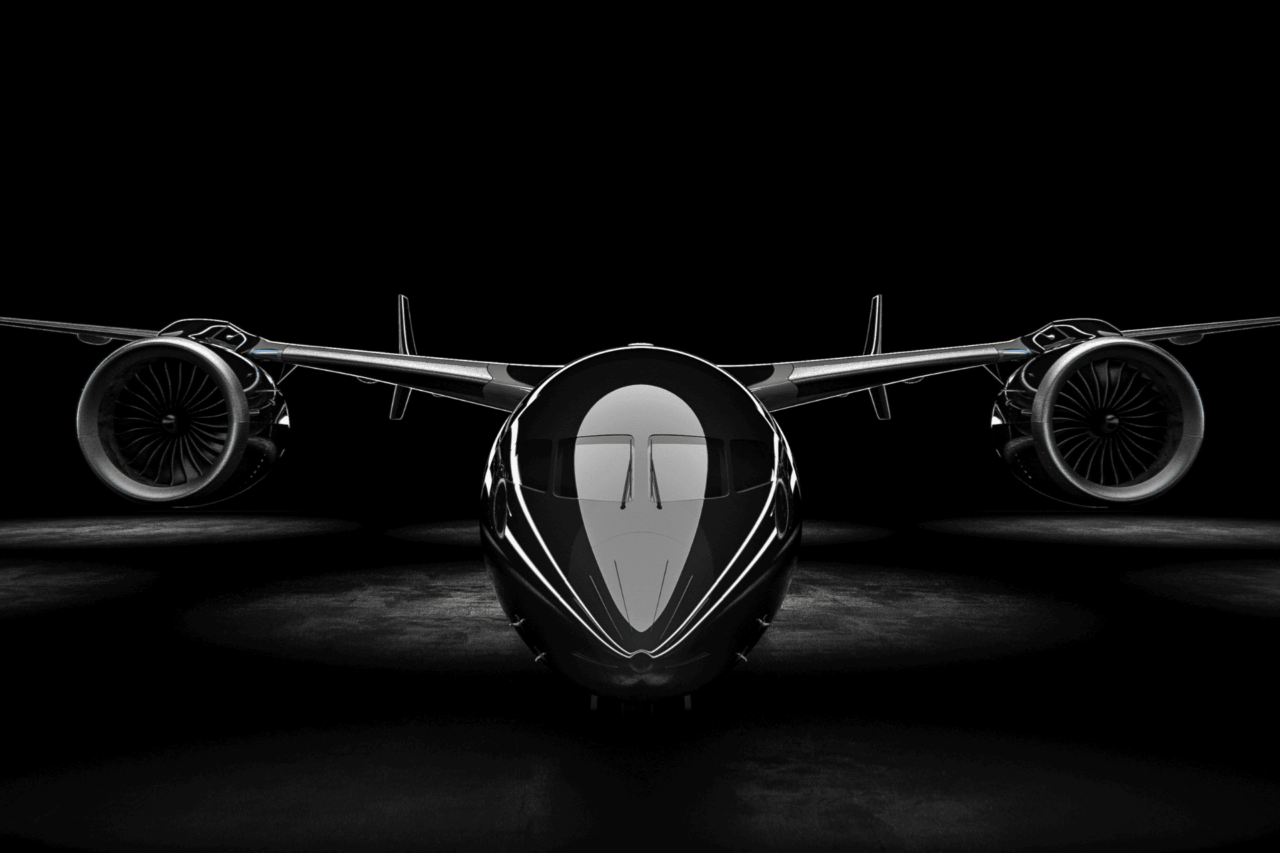

- The large jet segment is driving expansion, buoyed by the arrival of new models such as the Falcon 6X, Gulfstream G700/800, and Bombardier Global 8000.

Demographic Shifts

- Buyers under 45 now account for 29% of transactions, nearly doubling their share over the past decade.

- This rise is linked to wealth generated in technology, AI, and finance, along with a growing share of female buyers (29%).

- Entertainment industry clients make up 42% of this under-45 group.

Regional Dynamics

- U.S. demand is bolstered by political and economic confidence.

- Asia-Pacific is increasingly favoring large-cabin, newer jets.

- Younger high-net-worth buyers are driving growth in the Middle East and Africa.

- EMEA has regained its role as a key transaction hub, with cross-border sales between the Americas and EMEA representing a notable share of activity.

Market Conditions

- The average days-on-market rose to 166 in 2024 from a low of 122 in 2022, reflecting healthier inventory levels.

- Light aircraft have shown the strongest value retention since the 2022 peak, attracting first-time buyers and those upgrading from charter or fractional ownership.

- Midsize jets are gaining traction for their balance of range, performance, and in-flight features.

Sector Themes and Implications

The market’s shift from post-pandemic volatility to measured stability signals an environment conducive to long-term planning. The entrance of younger buyers is diversifying the client base, influencing both product demand and service expectations. At the same time, the strong performance of light and midsize aircraft points to an expanding gateway segment for new entrants into private aviation ownership.

For established players in the luxury aviation sector, these patterns suggest the need for targeted engagement strategies across emerging demographics, as well as positioning inventory to capture the high demand for modern, large-cabin aircraft in Asia and the Middle East.

Jetcraft’s report paints a portrait of a market moving with steadier altitude, confident, strategically expanding, and increasingly global. While political landscapes, economic cycles, and generational shifts will continue to shape demand, the fundamentals remain robust. Industry insiders should note the interplay between demographic evolution, technological preference, and geographic rebalancing as they plan their growth strategies in the years ahead.

To view the full report, visit: Jetcraft.com/market-report-2025

Stay up to date on the latest luxury industry news: https://worldluxurychamber.com/insights-news/